A Quick and Easy Option for Your Australian Online Tax Return Requirements

A Quick and Easy Option for Your Australian Online Tax Return Requirements

Blog Article

Maximize Your Advantages With the Online Tax Return Process in Australia

Browsing the on-line income tax return process in Australia supplies a calculated benefit for individuals looking for to optimize their financial advantages. Making use of the ATO's structured electronic system, taxpayers can successfully handle their obligations while accessing to useful resources, consisting of prospective deductions and refunds. By recognizing the nuances of the online filing structure and the vital deductions offered, one can considerably enhance their tax placement. Nevertheless, understanding the typical risks that might develop during this procedure is equally vital for maximizing results. What vital insights could change your method to this year's income tax return?

Comprehending the Online Tax Obligation System

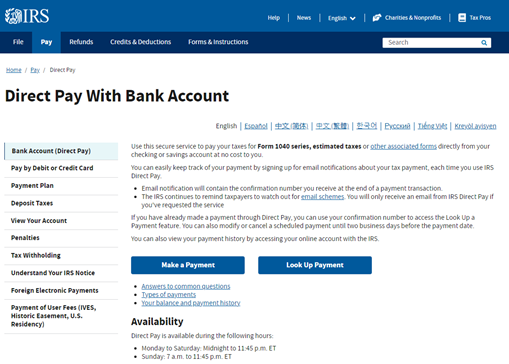

Understanding the online tax system in Australia is essential for taxpayers looking for to browse their commitments effectively. The Australian Taxes Workplace (ATO) has streamlined the procedure, enabling people to file their income tax return online, therefore boosting ease of access and minimizing the moment needed for submission. Australian Online Tax Return. This system is created to fit a wide variety of taxpayers, from staff members to freelance individuals, with various alternatives that deal with their particular scenarios

To start, taxpayers have to register for an account on the ATO's online platform, which acts as a centralized hub for handling tax-related tasks. Once registered, individuals can access their tax details, including income declarations and deductions, straight from their companies and monetary organizations. This function streamlines the procedure, as it lowers the requirement for manual information entry.

Moreover, the on the internet system supplies real-time updates and notifications, making certain that taxpayers remain educated concerning their tax obligation condition. The ATO's on the internet sources also consist of overviews and devices to assist individuals in comprehending their obligations, making the process more transparent. Overall, leveraging the on-line tax obligation system not only enhances effectiveness however additionally empowers Australians to take control of their tax obligation obligations successfully.

Secret Reductions and Refunds

Among the various aspects of the Australian tax obligation system, vital deductions and rebates play a vital function in reducing the total tax problem for individuals. Deductions specify costs that taxpayers can claim to lower their gross income, successfully lowering the quantity of tax obligation payable. Common reductions include work-related expenditures, such as uniforms, tools, and take a trip costs, which are sustained while earning a revenue.

Furthermore, taxpayers can declare deductions for self-education costs that directly connect to their current employment or enhance their abilities.

Recognizing these vital reductions and refunds is necessary for maximizing potential tax obligation financial savings. People must keep extensive records of their expenditures and get in touch with the Australian Tax Office (ATO) hop over to here standards to ensure all qualified insurance claims are precisely reported, ensuring an extra positive tax obligation result.

Step-by-Step Filing Overview

Filing your tax return in Australia can be a structured process when approached carefully. Begin by gathering all essential records, including your PAYG summaries, bank declarations, and receipts for deductible expenses. Guarantee you have your Tax Obligation File Number (TFN) convenient, as it is vital for identification

Next, choose an appropriate online platform for filing. The Australian Taxation Workplace (ATO) offers an on-line solution that guides you via the process. Develop or log Australian Online Tax Return right into your MyGov account connected to the ATO.

Once logged in, follow the prompts to finish your tax obligation he has a good point return. Input your income information properly and guarantee you claim all eligible reductions. This could consist of work-related expenditures, philanthropic contributions, or investment prices.

After loading in all relevant details, assess your return carefully to make certain accuracy. It's a good idea to check that all numbers are correctly gotten in which you haven't missed out on any kind of deductions.

Usual Errors to Stay Clear Of

When finishing your tax return online, it's vital to understand typical mistakes that can cause inaccuracies or delays. One constant error is neglecting to gather all necessary paperwork prior to beginning the procedure. Ensure that you have your income declarations, receipts for deductions, and any type of various other pertinent economic details easily offered.

An additional common error is falling short to double-check the accuracy of personal details. Basic blunders, such as incorrect names or tax obligation documents numbers, can cause handling hold-ups or difficulties. Australian Online Tax Return. Beware also to precisely report all income sources, including side tasks or financial investments, as omitting revenue can lead to penalties

Additionally, many taxpayers overlook claiming qualified reductions. Acquaint on your own with offered deductions to maximize your benefits. On the flip side, beware not to claim reductions that do not relate to you, as this can trigger audits.

Resources for Additional Aid

Various sources are readily available to assist taxpayers navigating the on-line tax return process in Australia. The Australian Taxes Workplace (ATO) gives thorough on the internet support, consisting of comprehensive directions and Frequently asked questions tailored to the online income tax return system. Their internet site features a devoted area for individuals, assisting taxpayers recognize their responsibilities, privileges, and reductions.

Along with the ATO resources, various tax obligation software application systems use straightforward user interfaces and detailed assistance. Much of these platforms include in-built calculators and tools to make the most of deductions, guaranteeing taxpayers can enhance their returns effectively.

For tailored assistance, taxpayers can access specialist tax consultatory services. Certified tax specialists can provide customized recommendations and assistance, which is particularly useful for those with complex economic scenarios or strangeness with tax laws.

Area companies likewise provide workshops and workshops, focusing on tax education and learning and help, especially for low-income earners and pupils. Internet sites such as Community Tax obligation Aid Australia offer important understandings and support to help taxpayers recognize their civil liberties and duties.

Verdict

In final thought, using the on the internet tax obligation return process in Australia provides a beneficial opportunity for taxpayers to maximize their financial results. Eventually, a detailed understanding and tactical strategy to online tax declaring can lead to considerable tax obligation savings and enhanced conformity with obligations.

In general, leveraging the on the internet tax obligation system not only improves performance but additionally encourages Australians to take control of their tax commitments effectively.

Among the different aspects of the Australian tax obligation system, crucial deductions and discounts play a crucial role in minimizing the general tax obligation worry for people.Numerous resources are available to help taxpayers navigating the on the internet tax obligation return procedure in Australia. The Australian Taxation Office (ATO) offers extensive on the internet support, consisting of in-depth instructions and FAQs tailored to the online tax return system. Ultimately, an extensive understanding and calculated technique to on the internet tax obligation declaring can lead to considerable tax obligation cost savings and enhanced conformity with commitments.

Report this page